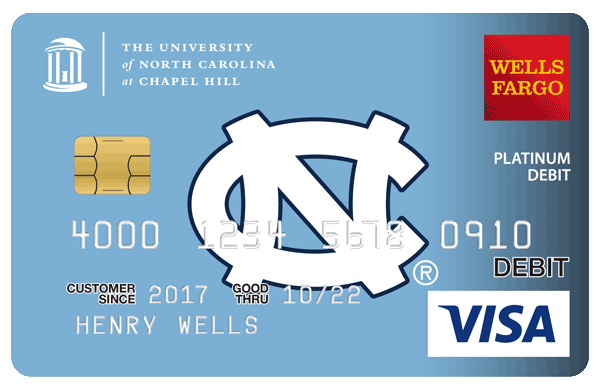

About the Wells Fargo UNC Debit Card

Link your UNC Debit Card1 to a Wells Fargo Clear Access Banking℠ or Everyday Checking account2 for banking convenience.

Link your UNC Debit Card1 to a Wells Fargo Clear Access Banking℠ or Everyday Checking account2 for banking convenience.

The University of North Carolina at Chapel Hill and Wells Fargo have teamed up to offer you optional banking convenience with your linked UNC Debit Card, exclusively for Tar Heels. Use it for your day-to-day financial needs on and off campus when it’s linked to a Wells Fargo checking account, with two account options ideal for students. Enjoy no-fee access to Wells Fargo ATMs nationwide, including the Wells Fargo ATMs on campus. Make everyday purchases and pay bills at participating retailers and service providers. Faculty and staff are also eligible to participate. Take advantage of this optional benefit today.

Visit wellsfargo.com/uncchapelhill for more details.

The Wells Fargo Campus Card Program offers a convenient way to access your money on and off campus, plus exclusive benefits for students, faculty and staff with a linked eligible Wells Fargo checking account. See more details about how we’re making college life a little easier, and find out more by watching our video about the Campus Card Program.

- The UNC Debit Card is a Visa® debit card issued by Wells Fargo Bank, N.A., and is a Wells Fargo Campus Card.

- Minimum opening deposit is $25. Monthly service fee for the Everyday Checking account is $10 and can be avoided when the primary account owner is 17 through 24 years old. Monthly service fee for the Clear Access Banking account is $5 and can be avoided when the primary account owner is 13 through 24 years old. When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee. Everyday Checking and Clear Access Banking customers have other way(s) to avoid the monthly service fee. Customers between 13 and 16 years old must open the Clear Access Banking account with an adult co-owner. See a Wells Fargo banker or the Consumer Account Fee and Information Schedule available at wellsfargo.com/depositdisclosures for more information about other fees that may apply and options to avoid the monthly service fee.

Wells Fargo may provide financial support to University of North Carolina at Chapel Hill for services associated with the UNC Debit Card.

Wells Fargo Bank, N.A. Member FDIC.

Contracts and Disclosures

The Department of Education’s (ED) Cash Management regulations 34 CFR 668.164(d)(4)(i)(B)(2) (issued October 2015), require institutions participating in T2 (Campus Card) arrangements to list and identify the major features and commonly assessed fees as well as a URL for the terms and conditions of each financial account offered under the arrangement.

Affinity Debit Card Agreement

ATM and Branch License

Wells Fargo Bank, N.A., Member FDIC.

Other Facts

In 2017, the Wells Fargo One Card Plus program, a UNC One Card Feature that linked debit capabilities with One Card IDs, was discontinued to ensure greater safety and keep ID costs low, as debit cards are now requiring microchips. Wells Fargo One Card Plus Cards that had already been activated will expire on the date provided on the One Card Plus.

UNC-Chapel Hill and Wells Fargo Campus Card Agreement

For the award year period of July 1, 2022 – June 30, 2023

- Total Number of student customers with linked accounts

- 2,071

- Annual mean linked account costs incurred

- $19.13

- Annual median linked account costs incurred

- $0.00

- Total consideration received by UNC-Chapel Hill

- $160,000

Wells Fargo may provide financial support to the University of North Carolina at Chapel Hill for services associated with the UNC Debit Card.